Identify what you are doing right, and make sure that you continue to do it over and over again. In other words, perfect what you do best. Regardless of the basic limitation, the key to turning an unprofitable technique into a profitable one is to focus first on the elements that are working. Still others may use reliable trading strategies and delineate clear trading plans, but they may allow their emotions to undermine their efforts.

:max_bytes(150000):strip_icc()/GannFans-4455374b2cb347e5be9d6cbdb73c0e65.png)

Other traders may leave too much of their trading plans unspecified, and thus, while under extreme pressure to perform, they may have difficulty executing the plan effortlessly.

#W d gann technique 3 how to

For example, a trader may know how to find a good trading opportunity, but may not have the proper capital to make it pay off.

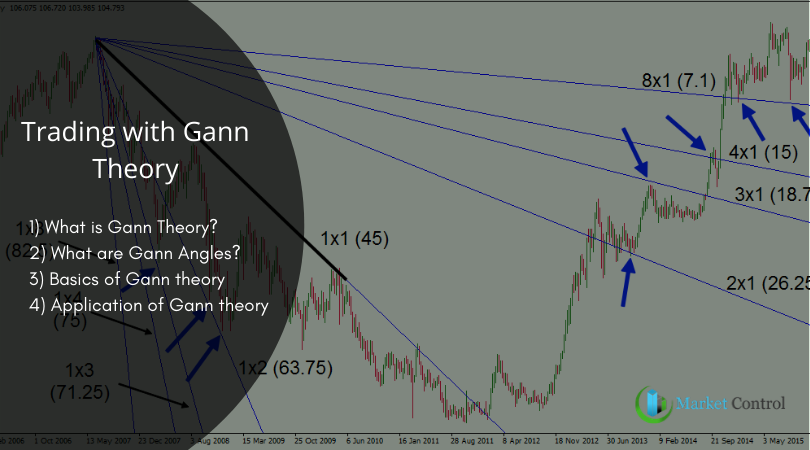

The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.Even the least profitable trader does something right. does not accept liability for your use of the website. The material on this website are provided for information purpose only. You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. In addition, readers are advised that past stock performance is not indicative of future price action. All Readers are advised to conduct their own independent research into individual stocks before making a purchase decision. All readers of this site must rely on their own discretion and consult their own investment adviser. I do not accept any liability/loss/profit occurring from the use of any content from this site. It will be strong move if there is space between the third or fourth bottom and the previous top.ĭISCLAIMERAll the views and contents mentioned in this site are merely for educational purposes and are not recommendations or tips offered to any person(s) with respect to the purchase or sale of the stocks / futures. These false moves start with high momentum.Ī breakout from a three-four day consolidation in a very narrow range results in sharp three day move.įaster moves start from third of fourth higher bottom. False breakout occurs when a move outside the consolidation zone fails to sustain in the following week and where the price has not gone beyond three points above the top. If it fails, a fast move in the other direction may be expected.įalse breakouts from consolidation result in very fast moves. (That is why AD line is a lagging indicator and generally moves up in the third wave)The third move trying to break the consolidation top/bottom is the most important. Weak stocks will generally not rally until either a test of the first bottom or a higher bottom is made by the market. * Reversal phase from bear to bull market Have different strategies for the four situations: Crossing of double or triple tops or bottomsĩ.

Crossing or coming together of angles from double or triple tops or bottomsĦ. Crossing of important angles originating at zeroĥ. Time cycles (vertical angles) (Press a short sale if there are three or four days of sideways movement after a high day and this is followed by a down day with high volume where low is lower than the low of the sideways movement and when this coincides with expiry of time cycles)Ĥ. Gann says that there can be nine mathematical proofs of any point of resistanceĢ.

0 kommentar(er)

0 kommentar(er)